Letter from the President

First, we want to offer a warm welcome to our newest AAAB members. As we head into open enrollment, election season and the holiday months, AAAB is keeping an eye on the developments across the country. In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates. Please make a note of the upcoming October meetings that are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved.

First, we want to offer a warm welcome to our newest AAAB members. As we head into open enrollment, election season and the holiday months, AAAB is keeping an eye on the developments across the country. In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates. Please make a note of the upcoming October meetings that are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved.

We welcome any questions or feedback you may have regarding AAAB, so please feel free to contact our leadership board via email at gfeng@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

ACA:

- Moda Health Expands ACA Offering to Idaho: Oregon-based insurer Moda Health reported it will expand its offerings to Idaho for the 2023 plan year. The insurer’s individual, family and employer group products will be available in 15 of the 44 counties. Moda Health currently enrolls 312,256 members, largely in Oregon, though it also has a small presence in Alaska and Texas.

- “Family Glitch” Fix: The Biden Administration has concluded the regulatory process around the Internal Revenue Service’s family glitch fix rule in October without having met with experts who raised serious concerns with the rule, as is required under Executive Order 12866. Former Trump Administration healthcare advisor, Brian Blase, called the action “shameful.” Also, numerous members of Congress and other people have pointed out that the proposed fix lacks legal basis. The main effect of this controversial fix: employee dependents enrolled in employer group coverage can replace that coverage with a subsidized exchange plan. According to the Paragon Health Institute, the cost of the rule will likely exceed $40 billion over a decade and the number of people with health insurance will marginally decline.

- Virginia Exchange: Following 2020 legislation that ordered a transition to a state-based insurance exchange, Virginia awarded a contract to GetInsured to build the new marketplace. The tech company currently supports seven other state-based exchanges, with Virginia’s marketplace slated to open in the fall of 2023. 235,820 people are currently enrolled in exchange plans in Virginia, with Elevance Health leading the pack at 44.0% market share.

- Bright’s Out: Bright Health Group will no longer offer individual and family health insurance plans or Medicare Advantage plans outside of California and Florida in 2023, eliminating options for patients in nine states. Affected states are Alabama, Arizona, Colorado, Florida, Georgia, Nebraska, North Carolina, Texas, and Tennessee. Bright Health also makes plans to exit six other markets in an effort to reduce cost and save to settle medical liabilities. The decision was part of Bright Health’s larger shift to a “fully aligned care model,” which doubles down on provider practices that serve aging and/or underserved patients.

Medicare/Medicaid:

- Drug Price Negotiation Power Needs Significant Rule Making: Now that Medicare can negotiate the price of prescription drugs it purchases, the Biden administration needs to figure out how it will hash out deals with drugmakers. AIS Health reported that implementation of the long-sought negotiation program will come with plenty of challenges and pitfalls. How will CMS select which drugs to negotiate? “I see three major decisions, in the short term, related to negotiation,” Matt Kazan, managing director at Avalere Health told AIS Health. “There is the definition of drugs that will be eligible for negotiation. The actual selection of the [first] 10, and then the rules of the road of the negotiation process itself. All three of those major decisions have to happen basically before this October 1, 2023, deadline — and maybe even sooner.” Those decisions could even have a meaningful impact on the bottom lines of drugmakers that don’t have drugs up for negotiation. That’s because the Inflation Reduction Act (IRA), the legislation that created the bargaining process, requires HHS to negotiate the most expensive drugs first.

- Star Ratings Down: Medicare Advantage star ratings show steep declines for 2023 as pandemic flexibilities disappeared. New findings from CMS show that the number of plans with four or more, star ratings is down compared to 2022. Approximately 51% of Medicare Advantage (MA) plans offering drug coverage will have a star rating of four or more in 2023, a sharp drop compared to 68% for 2022.

- 2023 Plans: 2023 Medicare Advantage landscape features geographic expansions, duals offerings, and Part B givebacks. Medicare beneficiaries in nearly every state will have more Medicare Advantage plans to choose from and see lower premiums this fall when shopping for coverage, according to CMS’s recently released landscape files for the 2023 plan year. Both major insurers and regional plans are touting new offerings such as Part B giveback plans, flexible spending features that include allowances for utilities, and enhanced dental coverage.

- Partnership for Veterans: Humana is partnering with USAA to launch a new plan that aims to complement the care veterans receive through the Department of Veterans Affairs (VA). The co-branded Humana USAA Honor plan will be available in eight states for Medicare beneficiaries and aims to be easier for veterans to access prescriptions and pharmacies closer to home and outside the VA system

Federal Activity:

Federal Register: In the month of October, there were eight new Federal register entries in the Healthcare Reform section. Those entries break down as follows:

- Agency Information Collection Activities: Proposed Collection; Comment Request (CMS): CMS is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- CHAMPVA Coverage of Audio-Only Telehealth, Mental Health Services, and Cost Sharing for Certain Contraceptive Services and Contraceptive Products Approved, Cleared, or Granted by FDA (VA): The VA proposes amending its medical regulations regarding the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) coverage.

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS): CMS is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Agency Information Collection Activities: Proposed Collection: Public Comment Request; Information Collection Request Title: Initial and Reconciliation Application Forms To Report Graduate Medical Education Data and Full-Time Equivalent (FTE) Residents Trained by Hospitals Participating in the Children's Hospitals Graduate Medical Education Payment Program; and FTE Resident Assessment Forms To Report FTE Residents Trained by Organizations Participating in the Children's Hospitals and Teaching Health Center Graduate Medical Education Programs, OMB No. 0915-0247-Revision (HRSA): In compliance with the requirement for the opportunity for public comment on proposed data collection projects of the Paperwork Reduction Act of 1995, HRSA announces plans to submit an Information Collection Request to the Office of Management and Budget.

- Affordability of Employer Coverage for Family Members of Employees (IRS): This document contains final regulations under section 36B of the Internal Revenue Code that amend the regulations regarding eligibility for the premium tax credit to provide that affordability of employer-sponsored minimum essential coverage for family members of an employee is determined based on the employee's share of the cost of covering the employee and those family members, not the cost of covering only the employee.

- Request for Information; National Directory of Healthcare Providers & Services (CMS): This request for information solicits public comments on establishing a National Directory of Healthcare Providers & Services that could serve as a ``centralized data hub'' for a healthcare provider, facility, and entity directory information nationwide.

- National Breast Cancer Awareness Month, 2022 (EOPOTUS): Declared for October.

- Agency Information Collection Activities: Proposed Collection; Comment Request (CMS): CMS is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

Bills Introduced in Key Health Committees:

- House Energy & Commerce: RECESS.

- House Ways & Means: RECESS.

- Senate Finance: RECESS.

- Senate HELP: RECESS.

Salient Congressional Bills:

- HR 4803-Acupuncture for Our Seniors Act: Facilitates provider billing for acupuncture in the Medicare program (AAAB Supports).

- HR 7512-Protecting Patients from Deceptive Health Plans Act: Limits the sale of supplemental products to consumers who already have comprehensive coverage. It would disallow the combination of accident and disability coverage. Currently in committee (AAAB Opposes).

- S 1002-Junk Plan Accountability and Disclosure Act of 2021: Would require pre-enrollment disclosures by insurers selling supplemental plans. Significant federal reporting requirements on enrollment and claims. Currently in committee (AAAB Opposes).

- S 4293-Pharmacy Benefit Manager Transparency Act of 2022: The legislation would make it illegal for PBMs to engage in “spread pricing” in which they charge health plans and payers more for a prescription drug than what they reimburse to the pharmacy, and then pocket the difference – the “spread” – as profit (AAAB Supports).

Around the Country:

- UHC Win in DOJ Case: Recently, UnitedHealth Group and Change Healthcare Inc. received welcome news when a federal judge ruled that their $13 billion deal could proceed despite the U.S. Dept. of Justice’s contention that it would illegally stifle competition. While it isn’t yet clear whether the DOJ will appeal the ruling, experts say the case itself offers important lessons for the healthcare industry and other firms mulling similar transactions. In its lawsuit seeking to block the UnitedHealth/Change deal, the DOJ argued that acquiring Change would result in UnitedHealth controlling more than 90% of the first-pass claims editing technology market by combining the two largest players.

- House Passes Bipartisan Mental Health Bill: Demand for mental health care has ballooned since the onset of the COVID-19 pandemic, and lawmakers from both parties have introduced legislation designed to improve access to such care. However, while the idea of increasing access to mental health care is appealing to virtually all members of Congress, there may be a tangle of policies that could achieve it. Senators Mike Crapo (R-ID) and Ron Wyden (D-OR) and other members in the Senate have been working on a bipartisan basis to try and advance a package of reforms. Crapo favors a smaller, $5 billion to $20 billion measure, while the budget of Wyden’s bill could reach $70 billion.

- RX Drone Delivery: Intermountain Healthcare (IHC), based in Salt Lake City, UT, announced the start of its drone pharmaceutical delivery program. IHC has partnered with Zipline, a drone delivery company that can transport packages up to four pounds while traveling up to 70mph. The drones are launched in a slingshot-like manner and then retrieved by an arresting line that snags the aircraft at the same launch location. After the initial phase in South Jordan, the Federal Aviation Administration (FAA) approved a drone flight service range of up to 50 miles. Combining this new program with Intermountains current telehealth programming, this allows patients to see a doctor and receive their medications without having to travel to the clinic or hospital.

- Biden Administration Extends the Public Health Emergency: On Oct. 13, the White House extended the COVID-19 public health emergency for the next 90 days. Daily deaths and case rates from the disease are declining, although there are still more than 300 COVID-19-related deaths each day. In advance of a potential surge of infections this winter, federal health officials urged people to get the updated COVID-19 vaccine. The public health emergency was first declared in January 2020 and has been renewed every 90 days since then. Among other things, the declaration of a public health emergency has helped to accelerate the authorization of treatments and vaccines and enabled the administration to ensure the public did not have to pay for them out of pocket.

- Mark Cuban’s Startup Pharmacy Signs Major Insurer: The Mark Cuban Cost Plus Pharmacy, the online pharmacy and generic manufacturing startup backed by the eponymous billionaire investor, recently struck its first deals with a health plan, Pennsylvania’s Capital Blue Cross, and a PBM, Rightway Healthcare Inc. The direct contracting deal represents a major step for the startup, which has done most of its business so far as a direct-to-consumer retailer.

- Bi-partisan Request: In October, Senators Maria Cantwell (D-WA) and Chuck Grassley (R-IA) sent a letter to Chairwoman Lina Khan of the Federal Trade Commission (FTC) advocating for increased transparency in the prescription drug pricing market. The letter cites the need for more transparency amidst increasing consolidation by pharmacy benefits managers and insurance providers. The senators, who introduced the Pharmacy Benefit Manager Transparency Act of 2022 earlier this year, noted in their letter that there is bipartisan support for investigations that could identify and limit deceptive and unfair drug pricing schemes. The senators both serve as members of the Senate Finance Committee, which has jurisdiction over Medicare, Medicaid, and tax policy – while Senator Cantwell is Chair of the Commerce, Science, and Technology Committee.

Members' Spot

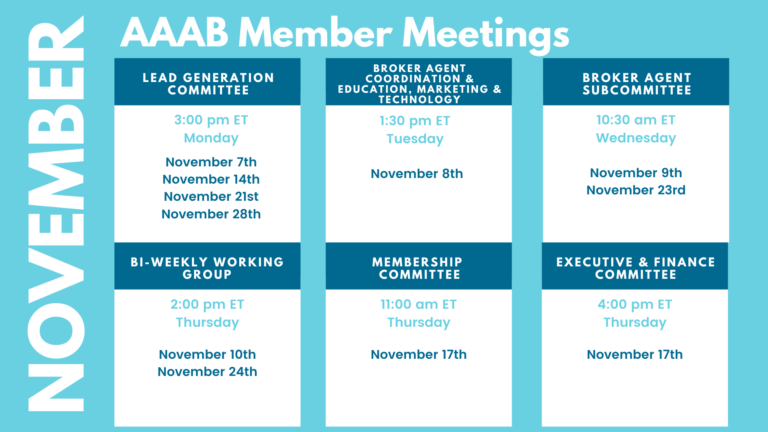

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email gfeng@aaab.net.