Letter from the President

I would like to issue a warm welcome to our newest AAAB members. In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates.

I would like to issue a warm welcome to our newest AAAB members. In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates.

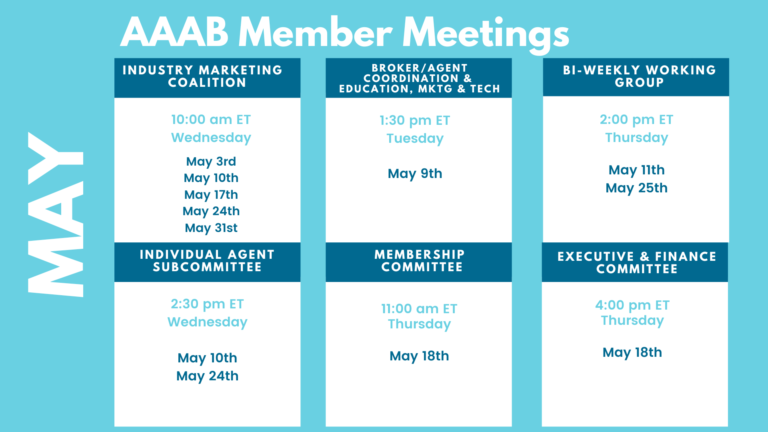

Please make a note of the upcoming May meetings that are listed in the Members' Spot. If you would like to join a committee, please reach out to get involved.

We welcome any questions or feedback you may have regarding AAAB, so please feel free to contact our leadership board via email at gfeng@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

ACA:

- HHS to Appeal Preventive Care Ruling: As legal experts predicted, the Biden administration has filed to appeal a judge's ruling that would block its ability to enforce preventive care mandates under the Affordable Care Act (ACA). Attorneys for the Department of Health and Human Services filed the notice of appeal Friday, just two days after the anticipated ruling was handed down. Analysts predict that the Supreme Court will have to weigh in yet again on the future of the ACA.

- ACA Rates Up But New Carriers Are Down: Premiums for the average Affordable Care Act benchmark increased by 3.4% for the 2023 coverage year, while the number of insurers entering the exchanges has slowed compared to prior years, a new analysis finds. The analysis, released recently by the Robert Wood Johnson Foundation and conducted by the think tank Urban Institute, comes amid record-breaking enrollment on the exchanges this year thanks to enhanced subsidies. Researchers pegged the slight premium hike on economic factors.

- Friday Health Plans Down in Texas and Supervised in Oklahoma: Friday Health Plans Inc., a Texas-based health insurance startup, has been placed under receivership by the Texas Department of Insurance and ordered to liquidate. The Travis County District Court found Friday Health to be insolvent, with total liabilities exceeding its admitted assets and total adjusted capital less than what is required under the Texas Insurance Code. Oklahoma Insurance Commissioner Glen Mulready announced that he has placed Friday Health Plans of Oklahoma, Inc. under the supervision of the Oklahoma Insurance Department. Mulready will designate an experienced supervisor to oversee and monitor Friday Health's finances and claims handling to ensure members, creditors, and the public are protected.

Medicare/Medicaid:

- The Centene-Evolent Partnership Adds Oncology Care: Centene Corp. and Evolent Health, a value-based clinical and administrative solutions provider, have expanded their partnership to bring improved oncology care to Centene’s Medicare Advantage members. The collaboration seeks to offer more personalized and coordinated oncology care for seniors, with the goal of improving health outcomes and quality of life for MA members. Centene and its WellCare subsidiary currently serve 1,279,623 MA members, making it the sixth-largest insurer in that market nationally. Centene in January completed its sale of Magellan Specialty Health to Evolent.

- Better Costs in Medicare Advantage: Researchers led by a team at Harvard University compared quality and utilization between Medicare Advantage (MA) and traditional Medicare in 2010 and again in 2017 and found that MA health maintenance organizations either outperformed or were the same as fee-for-service across seven patient reported measures in 2017. According to the study, the performance was the same or better in HMOs as well as Medicare preferred provider organizations when compared to traditional Medicare in both 2010 and 2017. In addition, the study found that the number of emergency department visits was 30% lower in MA HMOs compared to fee-for-service Medicare.

- UnitedHealth Still Optimistic on Medicare Advantage: Despite major regulatory overhauls of risk adjustments and slim rate increases, executives at UnitedHealth Group said the company is still expecting to hit its growth targets in Medicare Advantage. CEO Andrew Witty told investors on the company's earnings call Friday morning that "we do appreciate the Center for Medicare & Medicaid Services' decision in late March to phase in massive changes to risk adjustment in MA over the next three years. That gives UnitedHealthcare and other insurers time to adjust and respond, minimizing disruptions for beneficiaries as the changes roll out.”

- CMS Proposes Rule for Skilled Nursing: CMS released the Skilled Nursing Facility Prospective Payment System proposed rule for FY 2024, suggesting a 3.7% net increase in SNF Medicare Part A payments and revamping the Skilled Nursing Facility Value-Based Purchasing program's measures and incentives. As part of the administration's goal to ensure adequate staffing of and quality care in SNFs, the proposed rule advocates the adoption of Nursing Staff Turnover, Discharge Function Score, Long Stay Hospitalization, and Percent of Residents Experiencing One or More Falls with Major Injury as quality measures. The rule also proposes the replacement of the All-Cause Readmission measure with a more actionable Potentially Preventable Readmissions measure, the creation of a health equity adjustment to reward high-performing SNFs with a high percentage of dual eligible residents, and adjustment to the validation process for SNF quality measures.

- Florida Opens Bids on Medicaid: Florida last week issued a call for bids to serve the state’s Medicaid managed care program. This is only the second re-procurement since Florida launched its Medicaid managed care program in 2013, and the state is making several changes, including reducing its number of contract regions from 11 to 9. The state anticipates awarding contracts by December 2023, effective in January 2025. Florida currently enrolls 4,589,928 Medicaid beneficiaries in managed care plans, with Centene Corp., Elevance Health, and Humana Inc. leading the pack at 1,855,376 lives, 864,631 lives, and 805,047 lives, respectively.

- Clover Health Restructuring: Medicare Advantage-focused startup insurer Clover Health recently outlined restructuring efforts as it — like other insurance startups — struggles to achieve profitability. The biggest change is a new partnership with payer administrator UST HealthProof, which will take over Clover’s “core plan operations.” The company will also lay off 10% of its workforce. Clover anticipates annual cost savings of about $30 million beginning in 2024. The startup currently enrolls 82,398 Medicare Advantage members in six states.

Federal Activity:

Federal Register: In the month of April, there were 21 new Federal Register entries in the Healthcare Reform section. Those entries break down as follows:

- Patient Protection and Affordable Care Act, HHS Notice of Benefit and Payment Parameters for 2024 (HHS):This final rule includes payment parameters and provisions related to the HHS-operated risk adjustment and risk adjustment data validation programs, as well as 2024 user fee rates for issuers offering qualified health plans (QHPs) through Federally-facilitated Exchanges (FFEs) and State-based Exchanges on the Federal platform (SBE-FPs).

- Eligibility for a Qualified Health Plan Through an Exchange, Advance Payments of the Premium Tax Credit, Cost-Sharing Reductions, a Basic Health Program, and for Some Medicaid and Children's Health Insurance Programs (CMS): This proposed rule would make several clarifications and update the definitions currently used to determine whether a consumer is eligible to enroll in a Qualified Health Plan (QHP) through an Exchange; a Basic Health Program (BHP), in States that elect to operate a BHP; and for some State Medicaid and Children's Health Insurance Programs (CHIPs).

- Intent To Award a Single-Source Supplement To Provide the National Aging Network With Timely, Relevant, High-Quality Opportunities To Further Enhance Knowledge, Awareness and Models Related to Falls Prevention (ACL):The Administration for Community Living (ACL) announces the intent to award a single-source supplement to the current cooperative agreement held by the National Council on Aging (NCOA) for the National Falls Prevention Resource Center.

- Agency Information Collection Activities; Submission for OMB Review; Comment Request; Notice to Employees of Coverage Options Through Health Insurance Marketplace (DOL):The Department of Labor (DOL) is submitting this Employee Benefits Security Administration (EBSA)-sponsored information collection request (ICR) to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995 (PRA). Public comments on the ICR are invited.

- Advisory Committee on Immunization Practices (ACIP/CDC):In accordance with regulatory provisions, the Centers for Disease Control and Prevention (CDC) announces the following meeting of the Advisory Committee on Immunization Practices (ACIP). This meeting is open to the public. Time will be available for public comment.

- Health Data, Technology, and Interoperability: Certification Program Updates, Algorithm Transparency, and Information Sharing (HHS):This proposed rule would implement the Electronic Health Record (EHR) Reporting Program provision of the 21st Century Cures Act by establishing new Conditions and Maintenance of Certification requirements for health information technology (health IT) developers under the ONC Health IT Certification Program (Program).

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS):The Centers for Medicare & Medicaid Services (CMS) is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Medicaid Program; Final FY 2020, Final FY 2021, Preliminary FY 2022, and Preliminary FY 2023 Disproportionate Share Hospital Allotments, and Final FY 2020, Final FY 2021, Preliminary FY 2022, and Preliminary FY 2023 Institutions for Mental Diseases Disproportionate Share Hospital Limits (CMS):This notice announces the final Federal share (FS) disproportionate share hospital (DSH) allotments for Federal fiscal year (FY) 2020 and FY 2021, and the preliminary FS DSH allotments for FY 2022 and FY 2023.

- Medicare Program; Contract Year 2024 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, Medicare Cost Plan Program, and Programs of All-Inclusive Care for the Elderly (CMS): This final rule will revise the Medicare Advantage (Part C), Medicare Prescription Drug Benefit (Part D), Medicare cost plan, and Programs of All-Inclusive Care for the Elderly (PACE) regulations to implement changes related to Star Ratings, marketing and communications, health equity, provider directories, coverage criteria.

- Medicare Program; Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities; Updates to the Quality Reporting Program and Value-Based Purchasing Program for Federal Fiscal Year 2024 (CMS): This proposed rule would update payment rates, including implementing the second phase of the Patient Driven Payment Model (PDPM) parity adjustment recalibration. This proposed rule also proposes updates to the diagnosis code mappings used under PDPM, the SNF Quality Reporting Program (QRP), and the SNF Value-Based Purchasing (VBP) Program.

- Medicare Program; FY 2024 Inpatient Psychiatric Facilities Prospective Payment System-Rate Update (CMS): This proposed rule would update the prospective payment rates, the outlier threshold, and the wage index for Medicare inpatient hospital services provided by Inpatient Psychiatric Facilities (IPF), which include psychiatric hospitals and excluded psychiatric units of an acute care hospital or critical access hospital.

- Medicare Program; Inpatient Rehabilitation Facility Prospective Payment System for Federal Fiscal Year 2024 and Updates to the IRF Quality Reporting Program (CMS): This proposed rule proposes updates to the prospective payment rates for inpatient rehabilitation facilities (IRFs) for Federal fiscal year (FY) 2024.

- Postal Service Reform Act; Establishment of the Postal Service Health Benefits Program (PMO): The Office of Personnel Management (OPM) is issuing an interim final rule with comment period to establish and administer the Postal Service Health Benefits (PSHB) Program pursuant to the Postal Service Reform Act of 2022 (PSRA).

- World Autism Awareness Day, 2023 (Executive Office of the President)

- National Cancer Control Month, 2023 (Executive Office of the President)

- National Public Health Week, 2023 (Executive Office of the President)

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS): The Centers for Medicare & Medicaid Services (CMS) is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Medicare Program; FY 2024 Hospice Wage Index and Payment Rate Update, Hospice Conditions of Participation Updates, Hospice Quality Reporting Program Requirements, and Hospice Certifying Physician Provider Enrollment Requirements (CMS): This proposed rule would update the hospice wage index, payment rates, and aggregate cap amount for fiscal year (FY) 2024. This rule includes information on hospice utilization trends and solicits comments regarding information related to the provision of higher levels of hospice care; spending patterns for non-hospice services provided.

- Copayment Exemption for Indian Veterans (VA): The Department of Veterans Affairs (VA) adopts as final, with changes, a proposed rule to amend its medical regulations to implement a statute exempting Indian and urban Indian veterans from copayment requirements for the receipt of hospital care or medical services.

- TRICARE; Reimbursement of Ambulatory Surgery Centers and Outpatient Services Provided in Cancer and Children's Hospitals (DOD): The DoD is amending TRICARE reimbursement of ambulatory surgery centers (ASCs) and outpatient services provided in Cancer and Children's Hospitals (CCHs).

- Reporting to the National Practitioner Data Bank (VA): The Department of Veterans Affairs (VA) proposes to remove its regulations governing the National Practitioner Data Bank (NPDB). Instead, VA will rely on Department of Health and Human Services (HHS) regulations that govern the NPDB, a Memorandum of Understanding (MOU) between VA and HHS, and VA policy.

Bills Introduced in Key Health Committees:

- House Energy & Commerce: 81 bills filed in April–NOTABLE: H.R.2813 - To amend the Employee Retirement Income Security Act of 1974, the Public Health Service Act, and the Internal Revenue Code of 1986 to exclude from the definition of health insurance coverage certain medical stop-loss insurance obtained by certain plan sponsors of group health plans, and for other purposes. Sponsor: Good, Bob [Rep.-R-VA-5] (Introduced 04/25/2023)

- House Ways & Means: 66 bills filed in April–NOTABLE: None

- Senate Finance: 24 bills filed in April–NOTABLE: None

- Senate HELP: 25 bills filed in April–NOTABLE: None

Salient Congressional Bills:

- H.R.711: Throw Away Junk Plans Act — To amend title XXVII of the Public Health Service Act to eliminate the short-term limited duration insurance exemption with respect to individual health insurance coverage. NO ACTIVITY SINCE INTRODUCTION.

- H.R.1610/S.799 — To amend title XVIII of the Social Security Act to provide Medicare coverage for all physicians' services furnished by doctors of chiropractic within the scope of their license, and for other purposes. NO ACTIVITY SINCE INTRODUCTION.

- H.R.824 — Telehealth Benefit Expansion For Workers Act. NO ACTIVITY SINCE INTRODUCTION.

Around the Country:

- Mark Cuban’s Generic Drug Startup to Sell Branded Drugs: Mark Cuban Cost Plus Drug Co., the wholesale, direct-to-consumer drug manufacturer and pharmacy launched by the eponymous entrepreneur, will sell brand-name diabetes drugs from Janssen, a division of Johnson & Johnson. Cuban also says that the company will soon sell hypothyroidism treatment Tirosint (levothyroxine). The drugs are the first brand-name products to be sold by the company, which has previously focused exclusively on generics; Cuban says that the company plans to sell whatever brand-name drugs that it can, depending on drugmakers’ interest.

- Aetna Partners with Oshi Health: CVS Health’s Aetna is collaborating with Oshi Health, a digital health startup, to provide virtual care services for individuals with chronic digestive disorders. The value-based program will initially be available to select Aetna commercial members in six states (Florida, Maine, Massachusetts, Ohio, Pennsylvania and Texas) with more states to be added later this year. Oshi Health's digital platform offers symptom tracking, nutritional guidance, education, and connections to providers when in-person visits are required, while Aetna will provide coverage for virtual clinic visits with gastroenterologists and other specialists. Aetna currently enrolls 942,671 members in commercial risk-based plans in the six target states, and 3,159,396 nationwide.

- Federal Emergency Officially Over: President Joe Biden has signed a congressional resolution to end the national emergency responding to the COVID-19 pandemic after three years. Some of the emergency measures to respond to the virus and support the country's economic, health, and welfare systems have already been successfully wound down, while others are still being phased out.

- Uber into Prescription Delivery: Uber Technologies, Inc. announced late last month that it would embed same-day prescription delivery on its Uber Health app, expanding the offerings available to its healthcare provider and payer customers. Although the feature could help patients adhere to their medications and save costs for employers, PBMs and health plans, Uber faces numerous competitors in a crowded field and could have challenges getting the delivery feature covered, according to healthcare experts who spoke with AIS Health.

- Congress Trying to Stop DSH Payment Cuts:A bipartisan group of representatives introduced legislation recently that would delay billions in scheduled Medicaid disproportionate share hospital payment cuts by two years. DSH allotments are currently slated to be reduced by $8 billion, or about 54%, annually beginning in the 2024 fiscal year that would begin Oct. 1. The Supporting Safety Net Hospitals Act (H.R. 2665) introduced by Rep. Yvette Clarke, D-New York, bumps back the cuts until the fiscal year 2026.

- Kaiser Acquiring Geisinger:California-based integrated health system Kaiser plans to fold East Coast regional operator Geisinger into a new company, called Risant Health, which will operate nonprofit community health systems. Risant will operate separately from Kaiser and be led by Geisinger CEO Jaewon Ryu when the deal closes, pending regulatory approval. Kaiser plans to spend $5 billion in Risant over the next five years and add five or six health systems to Risant over that period, according to reports.

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email gfeng@aaab.net.