Letter from the President

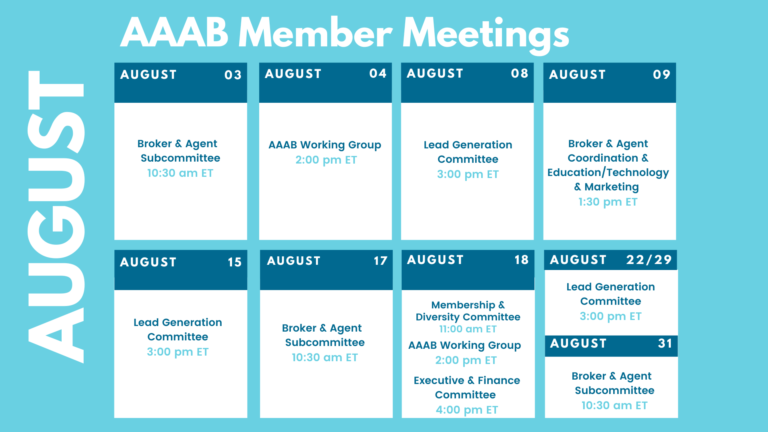

The summer is heating up and so is the healthcare industry! In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates and information from our most recent member committee meetings in Committee Updates. Please make a note of the upcoming August meetings that are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved.

The summer is heating up and so is the healthcare industry! In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates and information from our most recent member committee meetings in Committee Updates. Please make a note of the upcoming August meetings that are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved.

We welcome any questions or feedback you may have regarding AAAB, so please feel free to contact our leadership board via email at gfeng@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

ACA:

- Pandemic Will Shape 2023 Premiums: Researchers from the American Academy of Actuaries expect the most notable factors in 2023’s health insurance premium rate-setting will be COVID-19 variants, the expiration of enhanced premium subsidies in the individual marketplace, the resumption of Medicaid eligibility redeterminations, inflation, and provider labor shortages — a combination of public health policy and economic factors that represent the long tail of the COVID-19 pandemic.

- Cigna Expansion in Indiana: Aspire is pleased to partner with Cigna to offer their ACA Products in Indiana in 2023. Pending CMS approval, Cigna will offer products in the following counties in the Indianapolis area in 2023: Marion, Hamilton, Hendricks, Boone, Shelby, Hancock, Henry, and Johnson.

- Extension of Enhanced Subsidies: Senate Majority Leader Chuck Schumer confirmed that a key deal to lower drug prices and extend Affordable Care Act (ACA) subsidies is taking significant steps towards a vote in the chamber. Senate Democrats reached an agreement on a series of drug pricing-related reforms, including a $2,000 cap on out-of-pocket drug cost in Medicare Part D. With respect to the subsidies, there has been pressure on Congressional Democrats to quickly renew the enhanced subsidies as insurers are now putting together their rates for 2023. The fate of the bill is by no means certain, and the window for action is closing quickly.

Medicare/Medicaid:

- Proposed Rule: CMS is proposing a slight cut to doctor payments for 2023 as well as a slew of reforms to accountable care organizations and an expansion of dental service coverage.

- Watchdogs Suggest How to Improve Medicare Advantage During Hearing: During a recent hearing held by the House Energy and Commerce (E&C) Committee’s Subcommittee on Oversight and Investigations, lawmakers heard testimony from three federal watchdog agencies on ways CMS can achieve efficiencies in the Medicare Advantage program and improve oversight of MA organizations. However, while CMS’s actions were the subject of intense discussion, the agency itself wasn’t present.

- California’s Universal Medicaid: . California will become the first state to offer state-subsidized health insurance to all low-income undocumented immigrants eligible for the state’s Medicaid program starting in 2024, providing coverage to an additional 764,000 people. Currently, more than 12.3 million recipients are enrolled in Medicaid HMO plans in the state, according to the latest enrollment data in AIS’s Directory of Health Plans. Among the 24 market participants, L.A. Care Health Plan holds the highest market share with more than 2.4 million enrollees. Compared with December 2021, all insurers saw enrollment increases this year.

- Consolidation: Molina Healthcare plans to acquires My Choice Wisconsin, a Medicaid plan, in a $150 million deal. The Medicaid organization covers 44,000 Medicaid and managed long-term services and supports members. This deal will expand Molina’s footprint and represent a strategic growth initiative for acquiring value enhancing revenue streams at attractive valuations. My Choice Wisconsin will help Molina build out its Medicaid business in the state. The companies expect to merge at end of year.

Federal Regulations:

Federal Register: In the month of August, there were 15 new Federal register entries in the Healthcare Reform section. Those entries break down as follows:

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS): The Centers for Medicare & Medicaid Services is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Medicare Program; FY 2023 Hospice Wage Index and Payment Rate Update and Hospice Quality Reporting Requirements (CMS): This rule updates the hospice wage index, payment rates, and aggregate cap amount for Fiscal Year 2023. This final rule establishes a permanent mitigation policy to smooth the impact of year-to-year changes in hospice payments related to changes in the hospice wage index.

- Medicare Program; FY 2023 Inpatient Psychiatric Facilities Prospective Payment System-Rate Update and Quality Reporting-Request for Information (CMS): This final rule updates the prospective payment rates, the outlier threshold, and the wage index for Medicare inpatient hospital services provided by Inpatient Psychiatric Facilities, which include psychiatric hospitals and excluded psychiatric units of an acute care hospital or critical access hospital.

- Medicare and Medicaid Programs; CY 2023 Payment Policies Under the Physician Fee Schedule and Other Changes to Part B Payment Policies; Medicare Shared Savings Program Requirements; Medicare and Medicaid Provider Enrollment Policies, Including for Skilled Nursing Facilities; Conditions of Payment for Suppliers of Durable Medicaid Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS); and Implementing Requirements for Manufacturers of Certain Single-Dose Container or Single-Use Package Drugs To Provide Refunds With Respect to Discarded Amounts (CMS): This major proposed rule addresses: changes to the physician fee schedule (PFS); other changes to Medicare Part B payment policies to ensure that payment systems are updated to reflect changes in medical practice, relative value of services, and changes in the statute; Medicare Shared Savings Program requirements; updates to the Quality Payment Program; Medicare coverage of opioid use disorder services furnished by opioid treatment programs; updates to certain Medicare and Medicaid provider enrollment policies, including for skilled nursing facilities; updates to conditions of payment for DMEPOS suppliers; HCPCS Level II coding and payment for wound care management products; electronic prescribing for controlled substances for a covered Part D drug under a prescription drug plan or an MA-PD plan under the Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and Communities Act (SUPPORT Act); updates to the Medicare Ground Ambulance Data Collection System; and provisions under the Infrastructure Investment and Jobs Act.

- Medicare Program: Hospital Outpatient Prospective Payment and Ambulatory Surgical Center Payment Systems and Quality Reporting Programs; Organ Acquisition; Rural Emergency Hospitals: Payment Policies, Conditions of Participation, Provider Enrollment, Physician Self-Referral; New Service Category for Hospital Outpatient Department Prior Authorization Process; Overall Hospital Quality Star Rating (CMS): This proposed rule would revise the Medicare hospital outpatient prospective payment system (OPPS) and the Medicare ambulatory surgical center (ASC) payment system for Calendar Year (CY) 2023 based on our continuing experience with these systems.

- Department of Health and Human Services Repeal of HHS Rules on Guidance, Enforcement, and Adjudication Procedures (CMS): The Department of Health and Human Services (HHS or the Department) is issuing a final rule that repeals the regulations issued under two final rules: ``Department of Health and Human Services Good Guidance Practices,'' published in the Federal Register of December 7, 2020; and ``Department of Health and Human Services Transparency and Fairness.

- Agency Information Collection Activities; Request for Public Comment (EBSA X2): The Department of Labor (the Department), in accordance with the Paperwork Reduction Act, provides the general public and Federal agencies with an opportunity to comment on proposed and continuing collections of information.

- Agency Information Collection Activities; Proposed Collection; Comment Request; Prevention and Public Health Fund Evidence-Based Chronic Disease Self-Management Education Program Information Collection (ACL): The Administration for Community Living (ACL) is announcing an opportunity for the public to comment on the proposed collection of information listed above.

- Advisory Committee on Immunization Practices (CMS): In accordance with the Federal Advisory Committee Act, the Centers for Disease Control and Prevention (CDC), located within the Department of Health and Human Services (HHS), announces the following meeting of the Advisory Committee on Immunization Practices (ACIP).

- Student Assistance General Provisions, Federal Perkins Loan Program, Federal Family Education Loan Program, and William D. Ford Federal Direct Loan Program (Education Department): This notice of proposed rulemaking (NPRM) covers student loans and affordability issues.

- Nondiscrimination on the Basis of Sex in Education Programs or Activities Receiving Federal Financial Assistance (Education Department): The U.S. Department of Education (Department) proposes to amend the regulations implementing Title IX of the Education Amendments of 1972 (Title IX).

- Submission for OMB Review; National and Tribal Evaluation of the 2nd Generation of the Health Profession Opportunity Grants (Children and Families Administration): The Health Profession Opportunity Grants (HPOG) Program provides healthcare occupational training for Temporary Assistance for Needy Families recipients and other individuals with low incomes.

- Sunshine Act Meetings (National Council on Disability)

- Medicare and Medicaid Programs; Conditions of Participation (CoPs) for Rural Emergency Hospitals (REH) and Critical Access Hospital CoP Updates (CMS): This proposed rule would establish conditions of participation that Rural Emergency Hospitals (REH) must meet to participate in the Medicare and Medicaid programs.

Salient Congressional Bills:

- HR 7512 - Protecting Patients from Deceptive Health Plans Act: Limits the sale of supplemental products to consumers who already have comprehensive coverage. Would disallow the combination of accident and disability coverage. Currently in committee.

- S 1002 - Junk Plan Accountability and Disclosure Act of 2021: Would require pre-enrollment disclosures by insurers selling supplemental plans. Significant federal reporting requirements on enrollment and claims. Currently in committee.

Around the Country:

- Teladoc Expands Offering: Teladoc is further building out its primary care offering, Primary360, with new services that enhance care coordination and grow in-home options. Primary360 will now provide care coordination support and health plan in-network referrals alongside free same-day medication delivery from Capsule and in-home, on-demand phlebotomy services backed by Scarlet Health.

- CVS Fights Back: In a lawsuit that CVS Health Corp. intends to fight, the False Claims Act complaint accuses the parent company of colluding with its “supposedly firewalled” entities — the SilverScript Part D subsidiary, PBM CVS Caremark and CVS pharmacies — of striking secret rebate agreements with the drug makers that required SilverScript to block substitution on its formularies of generic drugs in favor of costlier brand-name alternatives.

- The INSULIN Act: According to Paragon Institute the INSULIN Act, introduced by New England Senators Jeanne Shaheen and Susan Collins, will cause considerable harm by reducing competition in the insulin market, raising insulin prices and health insurance premiums, increasing government spending, and erecting barriers to future innovation. It misdiagnoses the underlying problem and would hurt most diabetic patients and increase costs for many already facing high insulin prices. With at least nine biosimilar insulins available or in the pipeline, imposing price controls would chill the environment for future innovation.

- Hospital Crowding: Washington hospitals are sounding the alarm on overcrowded facilities and long wait times stemming from discharge challenges, care backlogs and other demands on the state’s healthcare system. The Washington State Hospital Association (WSHA) told local media in a recent news briefing that numerous member healthcare facilities—particularly those in the western, more populated counties—are at 120% to 130% capacity. The result is worsened patient care, long emergency department wait times and disruptions to ambulance services.

- Drug Approval: The FDA last week approved Incyte’s Opzelura cream for the treatment of nonsegmental vitiligo in patients aged 12 and older, making it the first-ever repigmentation therapy for the condition. It is also the first topical JAK inhibitor to gain FDA approval, having scored an atopic dermatitis nod in September 2021. For the treatment of atopic dermatitis, 52% of all insured lives have covered or better access to Opzelura under the pharmacy benefit.

Committee Updates

Committee Updates:

- Broker Committee: Finishing off the compliance toolbox initiative with all industry members.

- Independent Agent Subcommittee: Building a marketing plan to acquire individual and association members.

- Membership/Diversity/Product Committee: Work is ongoing to build up association members.

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email gfeng@aaab.net.