Letter from the President

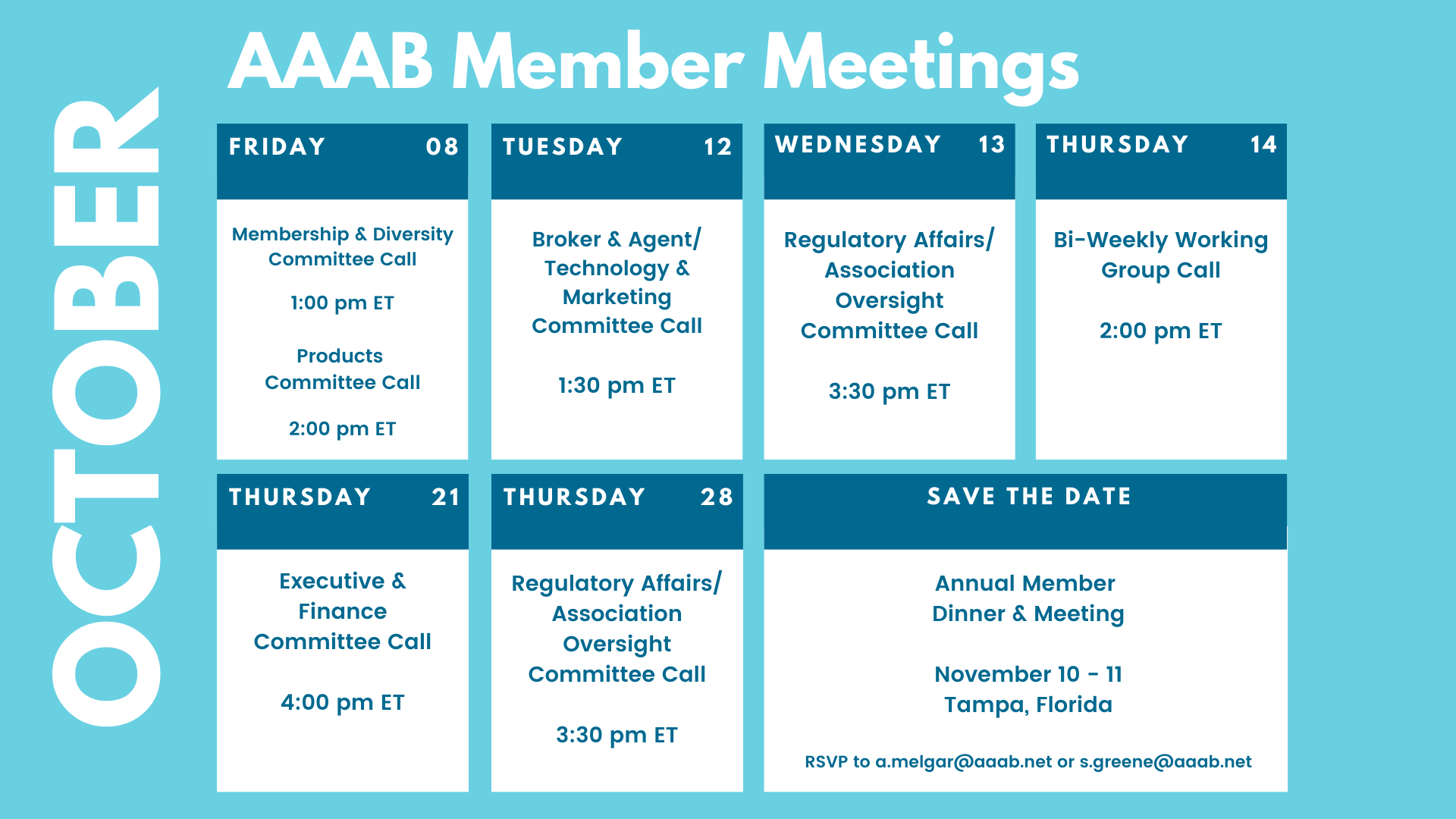

I want to welcome our newest members to AAAB and invite all of our members to join the upcoming Annual Member Dinner & Meeting, November 10-11 in Tampa, Florida.

I want to welcome our newest members to AAAB and invite all of our members to join the upcoming Annual Member Dinner & Meeting, November 10-11 in Tampa, Florida.

In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates, information from our most recent member committee meetings in Committee Updates. This month, we profile PPLSI, one of our Members in Member Highlight. Find out more about Greenwashing and Board Diversity in the ESG Corner.

For any questions or feedback regarding AAAB, please feel free to contact our leadership board via email at a.melgar@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

In the month of September, there were ten new Federal register entries in the Healthcare Reform section. Those entries broke down as follows:

- The Office of Personnel Management (OPM) issued an interim final rule to expand eligibility for enrollment in the Federal Employees Health Benefits Program to additional tribal employees (9/3/21).

- Three declarations from the Executive Office of the President for National Childhood Cancer Awareness Month, National Ovarian Cancer Awareness Month, and National Prostate Cancer Awareness Month (9/3/21).

- The Personnel Management Office, the IRS, the Employee Benefits Security Administration, and the HHS proposed rules for requirements related to air ambulance services, agent and broker disclosures, and provider enforcement (9/16/21).

- The Food and Drug Administration announced the availability of revised final guidance for the industry entitled “Questions and Answers on Biosimilar Development and the BPCI Act” (9/20/21).

- The CDC twice announced a meeting of the Advisory Committee on Immunization Practices (9/21/21 and 9/22/21).

- Treasury and HHS released final rule that sets forth revised 2022 user fee rates for issuers offering qualified health plans through federally-facilitated exchanges and state-based exchanges on the federal platform; repeals separate billing requirements related to the collection of separate payments for certain abortion services; expands the annual open enrollment period and navigator duties; implements a new monthly special enrollment period for qualified individuals; repeals the recent establishment of a direct enrollment option for exchanges; and modifies regulations and policies related to section 1332 waivers (9/27/21).

- The Department of Labor submitted an Employee Benefits Security Administration-sponsored information collection request (ICR) to the Office of Management and Budget for review and approval in accordance with the Paperwork Reduction Act of 1995 (PRA). Public comments on the ICR are invited.

Congress is seriously considering a new dental benefit in Medicare. There appears to be two schools of thought. One is to add dental (and perhaps vision and hearing) to Medicare Part B (seems to be favored), while the other is to create a Part T that would be ancillary coverages. Under the Part B scenario, it would be mandatory, but could be problematic for acceptance like Medicaid. However, the Part T scenario would be voluntary and would look a lot like a commercial plan. Don’t forget that considering doesn't mean passing, so this is far from a done deal, especially when one considers millions of Medicare beneficiaries already receive dental benefits from their Medicare Advantage plans.

No Surprises Act update: Proposed rule on 9/16/21 driven from the act and it is focused on air ambulances and broker/agent compensation.

There is a belief among the chatting class that if the Biden Administration and Congressional Democrats can get their “Soft Infrastructure” reconciliation bill across the finish line, there is a good possibility that the enhanced premium subsidies will be extended for several years.

Around the Country:

Interesting Trend: There are almost five million Medicare Advantage members in Employer Group Waiver Plans (EGWPs) which has recently grown at an annual rate of 6% per year. This is approaching 20% of the Medicare Advantage market. This is especially interesting because there was a time (about the time when Medicare Advantage came to the market) when many large employers were completely divesting their retiree group health plans.

In the Lone Star State: In September, Texas HB 4030 went into effect, making significant changes for Texas licensed (resident and non-resident) insurance professionals. It implements numerous changes to the Texas Insurance Code. The changes affect subagent designations, life and health insurance counselors, insurance service representatives, home office salaried employees, temporary licenses, provisional licenses, continuing education licenses, and nonresident agents and adjusters. Read the entire bill here.

Committee Updates

Broker & Agents’ Coordination & Education/ Technology & Marketing: The committee reviewed and edited our current working draft of an insurance sales code of conduct:

Imperatives:

- Be prepared: understand the products being sold (e.g. read the guides and brochures)

- Follow the approved sales script.

- Understand the consumers' needs.

- Present all possible product options to consumers.

- Review the policy’s limitations, exclusions, waiting periods, and pre-ex requirements with the consumer.

- Sell only approved/appointed products.

Givens:

- Never lie to a customer (if you don’t know, find out).

- Never sell a policy to someone who is not of sound mind.

- Never steer a customer to a plan because the commission is higher.

- Never be conflicted. If a conflict exists, refer the consumer to another agent.

- Never use a customer’s personal information for anything but what the customer has authorized.

Next step is getting it into a graphical format and starting to promote as we move towards our vision of creating a sales technique auditor.

On the TCPA toolbox, it was decided to slow down on development until we have the web infrastructure to protect it from outsiders. In the short term, we’ll make sure we get all member TCPA POCs identified to share (perhaps we’ll sponsor a call).

Executive Committee: The committee approved an IT budget and the expenses for the association’s annual meeting coming up in November. The association’s CFO will be presenting a financial update at the annual meeting which should include a draft of the association’s form 990.

Membership & Diversity: The actions of each subcommittee are as follows:

- Membership: This subcommittee is more focused pursuing about a dozen prospects to join the association. A key effort is expanding the range of companies to diversify our ranks.

- Diversity: The subcommittee discussed and recommended that the association continue to advance the education of ESG.

Products: We discussed a strategy for gathering data on products and a methodology to develop a template for a briefing sheet on each of the products. We also added pet insurance, cyber insurance, dental insurance, vision insurance, and non-insurance ancillary products to the list of products to advocate.

Regulatory Affairs & Association Oversight: Reviewed the insurance sales code of conduct and found no needed additions or deletions. Discussed new posts on the federal register and state initiatives. We decided to add Medicare dental to our tracking list which is now as follows:

- Rules promulgated by the No Surprise Act--latest proposed rule captured above

- Possible new rules on STM

- The proposed rules on the No Surprise Act above contain requirements to disclose broker commissions for STM

- NAIC Anti-Fraud task force focusing on the lead generation around STM sales and there is some concern that the scope may expand to the products

- Medicare dental

Member Highlight

In order for all of us to get to know our diverse member base, we are highlighting a member each month. This month it’s PPLSI (Pre-Paid Legal Services, Inc).

PPLSI is a trailblazer in the democratization of affordable access to legal protection and is the world's largest platform for legal, identity, and reputation management services. For 49 years, the PPLSI brand and its subsidiaries, LegalShield and IDShield, have provided individuals, families, businesses, and employers with the tools and services needed to affordably live a just and secure life.

Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to thousands of qualified, trusted attorneys and law firms. To learn more about the brands that currently protect over 4.5 million individuals and 140,000 businesses, visit LegalShield.com and IDShield.com.

ESG Corner

This month’s theme for ESG is keeping it real. Nobody likes a fake. That said, here are two areas that will only hurt your organization if you don’t keep it real:

- Greenwashing

- Board diversity

Greenwashing is a form of marketing spin where green public relations and marketing are deceptively used to persuade the public that an organization's products, aims, and/or policies are environmentally friendly. Chevron learned about the hazards of it back in 2010 when they launched an “environmental friendly” advertising campaign that did more harm than good when rainforest activists like the Rainforest Action Network and Amazon Watch denounced it. Best way to manage this is to avoid it. Keep it real!

A diverse board is simply good business but it is easier said than done. There are no set ways to achieve one but the key to this is actually achieving one. Not just saying it but doing it. Keeping it real. How does one know they’ve achieved a diverse board? There is no set regulation but many organizations that have achieved it have shared what they’ve done so it’s not difficult to figure out. One great guideline to this is the NASDAQ Board Diversity Matrix Instructions here. There is no one-size-fits-all solution but this can help point the right direction

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email a.melgar@aaab.net.