Letter from the President

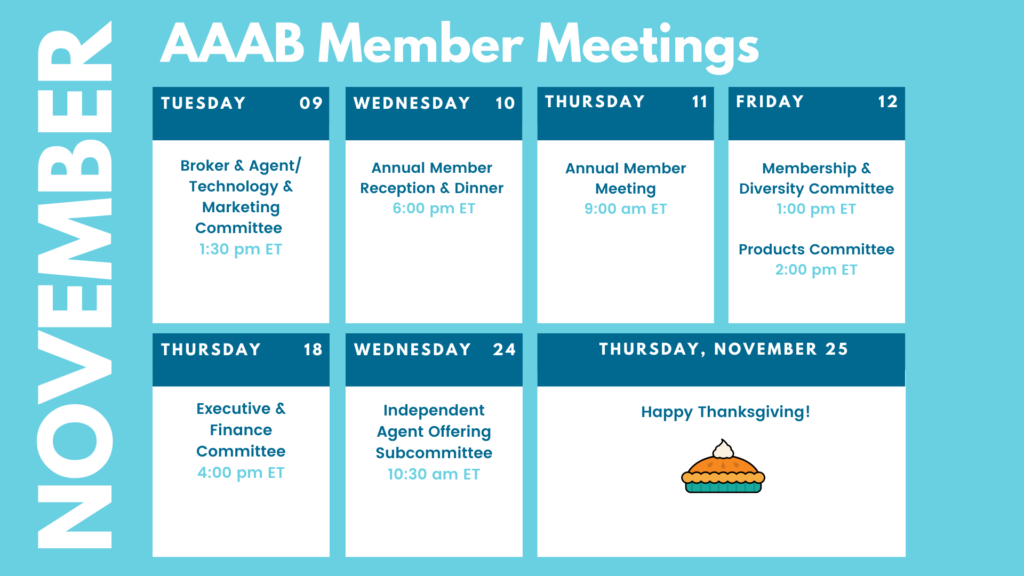

I am looking forward to meeting our members at the upcoming Annual Member Dinner & Meeting, November 10-11 in Tampa, Florida.

I am looking forward to meeting our members at the upcoming Annual Member Dinner & Meeting, November 10-11 in Tampa, Florida.

In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates, information from our most recent member committee meetings in Committee Updates. This month, we profile AFSLIC, one of our Members in Member Highlight. Find out more about how ESG impacts investments in the ESG Corner.

For any questions or feedback regarding AAAB, please feel free to contact our leadership board via email at a.melgar@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

Federal Regulations: In the month of October, there were 10 new Federal register entries in the Healthcare Reform section. Those entries broke down as follows:

- Declared National Breast Cancer Awareness Month, 2021 by the Executive Office of the President on 10/05/2021.

- The Office of Population Affairs (OPA) in the Office of the Assistant Secretary for Health issued a final rule to revise the regulations that govern the Title X family planning program (authorized by Title X of the Public Health Service Act) by readopting the 2000 regulations, with several revisions to ensure access to equitable, affordable, client-centered, quality family planning services for clients, especially low-income clients on 10/7/2021.

- The OPM, IRS, Treasury, EBSA, Labor, CMS, and HHS released a document that set forth interim final rules implementing certain provisions of the No Surprises Act, which was enacted as part of the Consolidated Appropriations Act, 2021 on 10/7/2021.

- The Bureau of Consumer Financial Protection published for public comment a proposed rule amending Regulation B to implement changes to the Equal Credit Opportunity Act (ECOA) made by section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) on 10/8/2021.

- HHS is proposed to repeal two final rules: “Department of Health and Human Services Good Guidance Practices,” published in the Federal Register of December 7, 2020; and “Department of Health and Human Services Transparency and Fairness in Civil Administrative Enforcement Actions,” published in the Federal Register of January 14, 2021 on 10/20/21.

- In accordance with the Federal Advisory Committee Act, the CDC announced a meeting of the Advisory Committee on Immunization Practices (ACIP) on 10/22/21.

- In compliance with the Paperwork Reduction Act of 1995, the Defense Health Agency announced a proposed public information collection seeking public comment on the provisions on 10/25/21

- CMS announced an opportunity for the public to comment on CMS' intention to collect information from the public on 10/26/21.

- HRSA released a notice seeking comments on two updated draft recommendations for (1) providing contraception and (2) screening for human immunodeficiency virus (HIV) infection, as part of the HRSA-supported Women's Preventive Services Guidelines on 10/28/21.

- HHS proposed to withdraw or repeal a final rule entitled "Securing Updated and Necessary Statutory Evaluations Timely'' (SUNSET final rule) on 10/29/21.

No Surprises Act Update: On 10/7/21 interim final rules were released to implement provisions of the No Surprises Act that provide for a Federal independent dispute resolution process to permit group health plans and health insurance issuers offering group or individual health insurance coverage and non-participating providers, facilities, and providers of air ambulance services to determine the out-of-network rate for items and services that are emergency services, non-emergency services furnished by non-participating providers at participating facilities, and air ambulance services furnished by non-participating providers of air ambulance services, under certain circumstances.

Medicare Dental Update: As of Halloween, President Biden and Congressional leaders were working on legislation that includes coverage for hearing services, but NOT dental or vision. This is far from over, but that’s a significant signal that dental and vision may not make the final cut.

Short-Term Health Update: Nothing specific at the federal level but we are seeing efforts from various task forces or groups of the NAIC that are ostensibly focused on lead generation for short-term health insurance but some are concerned that scope will expand to include the products. The association is taking a lead on this by taking a leadership role in lead generation conduct.

Around the Country:

JPMorgan Chase: The company continues its efforts to be a force in the healthcare industry. Despite the failure of its Haven joint venture with Amazon and Berkshire Hathaway, JPMoran has kicked off a new venture, Morgan Health, with the help of career health care executives. Morgan Health will focus on improving employer-sponsored healthcare with an emphasis on primary care and capitated reimbursement. The venture will build upon JPMorgan’s existing relationships with Cigna and Aetna. A secondary objective to reducing JPMorgan’s health costs is eventually selling analytics, benefit design and care coordination insights, and a capitated reimbursement model to other employer plan sponsors.

Insurers v. Pharma: Humana and Centene have filed lawsuits against pharmaceutical companies that are attempting to suppress competition to their branded drugs by offering patent settlements that essentially pay generic manufacturers not to bring their products to market. These so-called “pay for delay” deals pit these insurers against the likes of Merck & Company and Glenmark Pharmaceuticals. Lawsuits have been filed in New Jersey’s District Court.

NBA Insurance Fraud: Recently, eighteen former NBA players were charged with defrauding the NBA’s Health and Welfare Benefit Plan with a benefits scheme. The former players were charged with submitting false reimbursement claims for medical and dental services dating back to 2017. Overall, approximately $2.5 million were paid to these former players. All have been charged with conspiracy to commit health care fraud and wire fraud in the U.S. Southern District of New York.

Star Ratings Way Up: 90% of current MAPD enrollees are in plans that will be rated 4 stars or higher in 2022. This is up from 77% of MAPD enrollees in 2021. The explanation of this jump was a CMS decision during the pandemic to make several regulatory changes to its data collection process amid the emergency and placated payers by qualifying all contracts for its "extreme and uncontrollable circumstances" policy.

Committee Updates

Broker & Agents’ Coordination & Education/ Technology & Marketing: The committee is discussing next steps for advancing the insurance sales code of conduct. These steps would include creating a graphical format and developing steps for it’s promotion and build out into a training/certification process. A subcommittee has been formed to start work on an independent agent offering from the association. We are building that offering around three main elements:

- E&O: Association leaders are having discussions with possible partners for an E&O plan that would provide access to an inexpensive members-only plan.

- Lead generation: The life blood of any independent agent that is becoming more of a liability as regulators take a closer look. The association is looking to build a coalition of lead generation partners who are committed to a lead generation code of conduct.

- Product platform: All independent agents want to have a multitude of ancillary products so the association is going to leverage its company members’ products to provide an offering.

Executive Committee:The committee approved a motion to create a multi-company discount of 50% for company subsidiaries that wish to join the association as stand-alone members.

Membership & Diversity: The actions of each subcommittee are as follows:

- Membership: Not only discussed current pursuits of future members but also key reasons for companies to join the association.

- Diversity: The subcommittee discussed ESG topics for this month’s newsletter.

Products:

We reviewed a first draft of our product briefs to be used for meetings with regulators and others while advocating for various products. The key elements in the draft product brief are:

- Description

- State Footprint

- Size of Market

- Average Premium

- Average Persistency

- Regulator(s)

Regulatory Affairs & Association Oversight: Discussed new posts on the federal register and state initiatives. We discussed the draft AAAB response to the proposed CMS rule on transparency in agent/broker compensation. The association continues to track the No Surprise Act, Medicare dental/hearing/vision expansion, and Short-term Health Insurance initiatives.

Member Highlight

In order for all of us to get to know our diverse member base, we are highlighting a member each month. This month it’s American Financial Security Life Insurance Company ("AFSLIC").

American Financial Security Life Insurance Company (“AFSLIC”) was organized in Missouri in January 1957, under the name of Survivor’s Benefit Insurance Company. In 1981, the name was changed to Penn Diversified Insurance and Annuity Company, and in May 1989, changed to its current name of American Financial Security Life Insurance Company. The company has been under current ownership since 2008, and now provides a broad range of insurance services in over 35 States.

American Financial Security Life Insurance Company (“AFSLIC”) was organized in Missouri in January 1957, under the name of Survivor’s Benefit Insurance Company. In 1981, the name was changed to Penn Diversified Insurance and Annuity Company, and in May 1989, changed to its current name of American Financial Security Life Insurance Company. The company has been under current ownership since 2008, and now provides a broad range of insurance services in over 35 States.

Core offerings include Short Term Medical, Fixed Indemnity, Accident, Critical Illness and Medical Stop-Loss Insurance products, in both individual and group markets. With corporate headquarters located in southern Florida, a regional office in New York City, and a nationwide network of distributors and agents, AFSLIC is able to meet and better serve the needs of our members throughout the country.

ESG Corner

This month we take a step or two back and dig in more on the topic of why should one care about ESG? Many reasons but one significant reason is investors. Some investors may not care about ESG but many do in this day and age. For that reason, it’s vital to understand a basic framework of what many investors would be looking for. One framework from Trillium Asset Management includes:

Environment:

- Issuance of sustainability reports

- Documentation of limiting harmful pollutants and chemicals

- Initiatives designed to lower greenhouse gas emissions

- Incorporation of renewable energy sources into business activities

Social:

- Deals with companies that operate an ethical supply chain

- Policies supporting inclusion and encouraging diversity

- Has policies to protect against sexual misconduct

- Pays fair wages

Governance:

- Embraces diversity on the board of directors

- Embraces corporate transparency

- Employs a CEO independent of the board chair

There are many ways to manifest or demonstrate a commitment to a framework such as this. Key thing is having a program in place to show (talk is cheap).

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email a.melgar@aaab.net.