Letter from the President

In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates and information from our most recent member committee meetings in Committee Updates. All of the May meetings are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved. The AAAB Board will be holding their Q2 meeting on June 2, so please feel free to forward any issues or ideas for discussion.

In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates and information from our most recent member committee meetings in Committee Updates. All of the May meetings are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved. The AAAB Board will be holding their Q2 meeting on June 2, so please feel free to forward any issues or ideas for discussion.

For any questions or feedback regarding AAAB, please feel free to contact our leadership board via email at gfeng@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

ACA:

- Biden Administration Looks to IRS to ‘Fix’ the ObamaCare ‘Family Glitch: The family glitch is an unintended consequence of the ACA where a person offered employer group coverage for just them could disqualify other family members from access to subsidies. The Biden Administration has proposed a rule, if finalized, where the IRS will expand ObamaCare subsidies by billions of dollars a year beyond what Congress authorized. A lawsuit may result from this action.

- Executive Order: Recently, President Biden issued an executive order titled Continuing to Strengthen Americans’ Access to Affordable, Quality Health Coverage. The executive order gives follow-up to the executive order issued on January 28, 2021. Detailed in this executive order are recent actions that have been taken by the Biden administration to act in accordance with and further the agenda of the previous executive order. Examples include facilitating Medicaid expansion in Missouri and Oklahoma, expanding postpartum Medicaid coverage, and the Special Enrollment Period that was opened under the ACA in 2021.

- Average ACA Benchmark Plan Premium Continues to Drop in 2022: The national average premium for the second-lowest-cost silver plan or benchmark plan, sold through the Affordable Care Act exchanges is $438 per month in 2022, a 1.8% drop compared to 2021, according to an Urban Institute analysis. Average benchmark premiums, by state, ranged from $309 in New Hampshire to $766 in West Virginia. The premium variation was associated with the type and number of insurers participating in a region. The presence of a Medicaid insurer led to lower benchmark premiums. In 2021, the benchmark premium in a rating region with only one insurer was $189.5 higher per month than in regions with five or more insurers.

Medicare:

- Anthem’s NYC contract is in limbo: The move from fee-for-service (FFS) Medicare to group MA coverage administered by Anthem’s Empire Blue Cross Blue Shield in partnership with EmblemHealth was expected to save up to $600 million annually. However, the transition faced considerable pushback, and a group of retirees last fall sought a preliminary injunction that delayed implementation of the new contract. The petitioners asserted that the city did not engage impacted retirees and instead consulted a committee composed entirely of municipal labor union representatives. On March 3, Manhattan Supreme Court Justice Lyle Frank ruled that the city’s attempt to charge the monthly fee violated New York City law, which stipulates that the municipal employer must “pay the entire cost of health insurance coverage for city employees, city retirees and their dependents.” The legal uncertainties combined with budgetary unknowns appeared to give the comptroller pause.

- Insurers Applaud New Medicare Coverage for OTC COVID Tests: Medicare Part B will now cover eight over-the-counter, at-home COVID-19 tests per month with no cost sharing for beneficiaries starting April 4, according to a new Biden Administration policy. Medicare Part B and Medicare Advantage beneficiaries will be able to order the tests from a government website or acquire them from participating retailers through the end of the public health emergency.

- Medicare Advantage’s Two-Sided Risk Model Associated With Reduced Acute Care Use: Value-based payment models can significantly lower acute care usage among Medicare beneficiaries, suggested a study of nearly 500,000 Medicare Advantage members published last month in JAMA Network Open. The study, which analyzed data collected between December 2017 and January 2019, was led and reviewed by the Humana Healthcare Research Human Subject Protection Office. MA beneficiaries participating in two-sided risk models had lower rates of hospitalizations, observation stays and emergency department visits compared with fee-for-service (FFS) Medicare enrollees. This effect was particularly striking in avoidable acute care use — the two-sided risk model was associated with a 15.6% reduction in avoidable hospitalizations. Researchers noted a lack of significant differences between FFS and upside-only risk models, which “suggests that downside financial risk may play a key role in effective value-based payment arrangements.”

- Payers Applaud as CMS Stands Ground on Aduhelm Coverage:In a move derided by some health care stakeholders and celebrated by others — including private payers — CMS on April 7 finalized its National Coverage Determination (NCD) for an Alzheimer’s treatment that has been steeped in controversy since it received accelerated approval last June. The final coverage decision largely affirmed what CMS had proposed in its draft NCD: Medicare will cover Biogen Inc.’s Aduhelm (aducanumab) only for patients enrolled in randomized, controlled clinical trials conducted either through the FDA or the National Institutes of Health. But the agency also offered slightly looser requirements for any similar drugs that receive traditional, rather than accelerated, FDA approval.

Federal Regulations: In the month of May, there were 23 new Federal register entries in the Healthcare Reform section. Those entries break down as follows:

- Medicare Program; FY 2023 Inpatient Psychiatric Facilities Prospective Payment System-Rate Update and Quality Reporting-Request for Information (CMS):This proposed rule would update the prospective payment rates, the outlier threshold, and the wage index for Medicare inpatient hospital services provided by Inpatient Psychiatric Facilities (IPF), which include psychiatric hospitals and excluded psychiatric units of an acute care hospital or critical access hospital.

- Medicare Program; FY 2023 Hospice Wage Index and Payment Rate Update and Hospice Quality Reporting Requirements (CMS):This proposed rule proposes to establish a permanent mitigation policy to smooth the impact of year-to-year changes in hospice payments related to changes in the hospice wage index.

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS–2 notices): The Centers for Medicare & Medicaid Services (CMS) is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Request for Nominations for the Board of Governors of the Patient-Centered Outcomes Research Institute (GAO): The Patient Protection and Affordable Care Act gave the Comptroller General of the United States responsibility for appointing up to 21 members to the Board of Governors of the Patient-Centered Outcomes Research Institute.

- Agency Information Collection Activities: Proposed Collection; Comment Request (CMS–3 notices):The Centers for Medicare & Medicaid Services (CMS) is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Medicare Program; Inpatient Rehabilitation Facility Prospective Payment System for Federal Fiscal Year 2023 and Updates to the IRF Quality Reporting Program (CMS):This rulemaking proposes updating the prospective payment rates for inpatient rehabilitation facilities (IRFs) for Federal fiscal year (FY) 2023.

- Affordability of Employer Coverage for Family Members of Employees (IRS):This document contains proposed regulations under section 36B of the Internal Revenue Code (the “Code”) that would amend the existing regulations regarding eligibility for the premium tax credit (“PTC”) to provide that affordability of employer-sponsored minimum essential coverage (employer coverage) for family members of an employee is determined based on the employee's share of the cost of covering the employee and those family members, not the cost of covering only the employee.

- Agency Information Collection Activities; Submission for OMB Review; Comment Request; Affordable Care Act Grandfathered Health Plan Disclosure, Recordkeeping Requirement, and Change in Carrier Disclosure (DOL):The Department of Labor is submitting this Employee Benefits Security Administration (EBSA)-sponsored information collection request (ICR) to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995.

- Agency Information Collection Activities; Submission for OMB Review; Comment Request; Summary of Benefits and Coverage and Uniform Glossary Required Under the Affordable Care Act (DOL):The Department of Labor is submitting this Employee Benefits Security Administration (EBSA)-sponsored information collection request (ICR) to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995.

- Agency Information Collection Activities; Submission for OMB Review; Comment Request; Affordable Care Act Advance Notice of Rescission (DOL): The Department of Labor is submitting this Employee Benefits Security Administration (EBSA)-sponsored information collection request (ICR) to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995 (PRA).

- Proposed Information Collection Activity; National and Tribal Evaluation of the 2nd Generation of the Health Profession Opportunity Grants (Children and Families Administration): The Health Profession Opportunity Grants Program provides healthcare occupational training for Temporary Assistance for Needy Families recipients and other individuals with low incomes.

- Continuing To Strengthen Americans' Access to Affordable, Quality Health Coverage (Executive Office of the President):It directs executive departments and agencies (agencies) with authorities and responsibilities related to Medicaid and the ACA to review existing regulations, orders, guidance documents, policies, and any other similar agency actions (collectively, agency actions) to determine whether such agency actions are inconsistent with this policy.

- Access to Federal Employees Health Benefits (FEHB) for Employees of Certain Tribally Controlled Schools (Personnel Management Office):This rule finalizes an interim rule which expanded access to enrollment in the Federal Employees Health Benefits (FEHB) Program to additional tribal employees.

- Medicare Program; Maximum Out-of-Pocket (MOOP) Limits and Service Category Cost Sharing Standards (CMS): This final rule with comment period will finalize the two remaining proposals from the proposed rule titled “Medicare and Medicaid Programs; Contract Year 2021 and 2022 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, Medicaid Program, Medicare Cost Plan Program, and Programs of All-Inclusive Care for the Elderly” which appeared in the Federal Register on February 18, 2020 (February 2020 proposed rule).

- Advisory Committee on Immunization Practices (CMS):In accordance with the Federal Advisory Committee Act, the Centers for Disease Control and Prevention (CDC) announces the following meeting of the Advisory Committee on Immunization Practices.

- Medicare Program; Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities; Updates to the Quality Reporting Program and Value-Based Purchasing Program for Federal Fiscal Year 2023; Request for Information on Revising the Requirements for Long-Term Care Facilities To Establish Mandatory Minimum Staffing Levels (CMS):This proposed rule would update: Payment rates; forecast error adjustment; diagnosis code mappings; the Patient Driven Payment Model (PDPM) parity adjustment, the SNF Quality Reporting Program (QRP), SNF Value-Based Purchasing (VBP) Program.

- Proposed Collection; Comment Request for Patient Protection and Affordable Care Act Patient Protection Notice (IRS):The Internal Revenue Service, as part of its continuing effort to reduce paperwork and respondent burden, invites the general public and other Federal agencies to take this opportunity to comment on continuing information collections, as required by the Paperwork Reduction Act of 1995.

- Availability of Program Application Instructions for MIPPA Program Funds (Community Living Administration):The Medicare Improvement for Patients and Providers Act (MIPPA) program supports states through grants to provide outreach and assistance to Medicare beneficiaries with limited incomes and assets to ensure the beneficiaries have access to all Medicare related benefits available to them.

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS):CMS is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Medicare Program; Implementing Certain Provisions of the Consolidated Appropriations Act, 2021 and Other Revisions to Medicare Enrollment and Eligibility Rules (CMS):This proposed rule would implement certain provisions of the Consolidated Appropriations Act, 2021 (CAA).

Around the Country:

- Medical Bills Still a Concern: According to the Kaiser Family Foundation’s March 2022 Tracking Poll, 55% of Americans said Inflation was their top concern; 71% say they are “very/somewhat worried” about being able to afford gasoline or other transportation costs followed by unexpected medical bills (58%), monthly utilities (50%), food (47%), long-term care services (45%), health insurance deductible (44%), rent/ mortgage (43%), prescription drugs (43%) and health insurance premiums (36%).

- Bipartisanship: On April 4, the House passed two health bills with bipartisan support. H.R. 5657, the Medical Marijuana Research Act, passed 343-75 and would streamline the registration process for conducting research with marijuana while maintaining oversight and control by HHS and the Drug Enforcement Administration. H.R. 1916, the Ensuring Lasting Smiles Act, passed 310-110 and would (1) require all individual and group market health plans to cover medically necessary treatment resulting from congenital anomalies or birth defects, and (2) provide coverage for any service or treatment that is medically necessary to restore or achieve a normal appearance or function of the body.

- California Partnership: Blue Shield of California and Walgreens are launching new Health Corners in 12 Walgreen stores in the San Francisco Bay area and Los Angeles County. At the Health Corner locations, Blue Shield members and customers will be able to connect with health advisers who can offer simple in-store care and assistance with preventive screenings, chronic care management, and medications. The Health Corners initiative is part of Blue Shield’s efforts to transform healthcare and ease access to care and Walgreens’ work to expand its patient care offerings. The two companies are planning to open eight more Health Corner locations by midyear.

- UnitedHealth Acquisition: Both UnitedHealth Group and Change Healthcare Inc. are making it increasingly clear that they aren’t giving up on their proposed $13 billion transaction despite federal regulators’ move to block the deal. However, one antitrust attorney is skeptical that the two companies will ever end up combining.

- Non-profit Hospitals: The Lown Institute issued its latest report card on not-for-profit hospitals finding most undeserving of their tax breaks. In its analysis of 2019 tax filings by 1,800 hospitals affiliated with 275 systems, it concluded. 83% of health systems spent less on charity than the value of their tax breaks, resulting in an $18.4 billion total 'fair share deficit’ in 2019—an increase from 2018 when 72% had a ‘fair share deficit’ that totaled $17 billion. 227 of the 275 spent less on charity than the value of their tax breaks. Hospital total fair share deficits were concentrated in seven states accounting—California, Massachusetts, Pennsylvania, Ohio, Illinois, New York, and Michigan. In response, the American Hospital Association (AHA) released a statement criticizing the Lown Institute's “faulty methodology” and defending hospitals' use of financial resources. Per AHA, "hospitals of all types have provided nearly $745 billion in uncompensated care to patients since 2000.”

Committee Updates

Committee Updates:

- Broker Committee: The broker committee reviewed the compliance toolbox which will be launched this month. The association leadership team will meet with all industry members wishing to review their compliance programs.

- Independent Agent Subcommittee: We continue to work on implementing an independent agent membership level in the association

- Membership/Diversity/Product Committee: The committee’s work continues to focus on increasing the industry membership base.

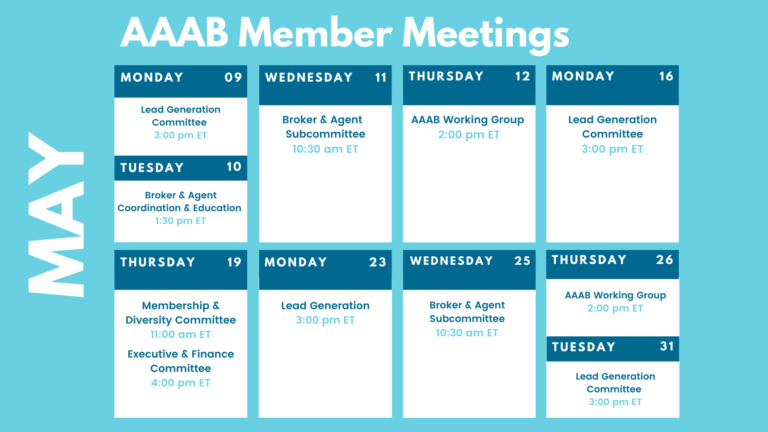

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email gfeng@aaab.net.

Coming Soon