Letter from the President

Happy New Year AAAB Members! We are excited to usher in 2022 for our membership. Stay tuned for some new and exclusive developments as we build a secure member portal experience and new toolbox offerings for you this year.

Happy New Year AAAB Members! We are excited to usher in 2022 for our membership. Stay tuned for some new and exclusive developments as we build a secure member portal experience and new toolbox offerings for you this year.

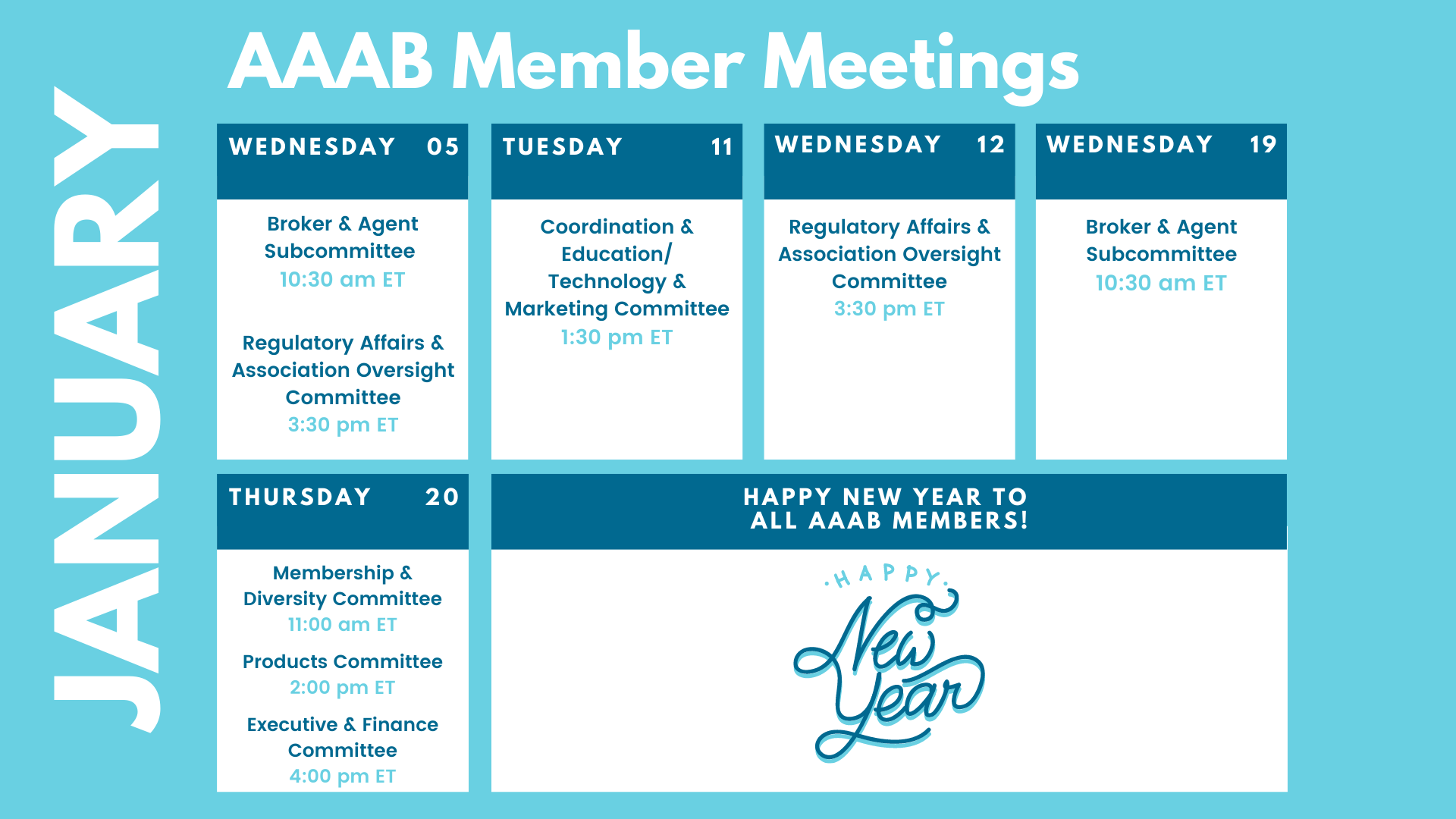

In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates and information from our most recent member committee meetings in Committee Updates. The best way to get involved with AAAB is to join and participate in the committee update meetings. Plan to attend one of our upcoming meetings after taking a look at the January calendar in the Members' Spot.

For any questions or feedback regarding AAAB, please feel free to contact our leadership board via email at a.melgar@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

Federal Regulations: In the month of December, there were thirteen new Federal register entries in the Healthcare Reform section. Those entries break down as follows:

- Information Reporting of Health Insurance Coverage and Other Issues (IRS): This document contains proposed regulations providing that "minimum essential coverage,'' as that term is used in health insurance-related tax laws, does not include Medicaid coverage that is limited to COVID-19 testing and diagnostic services provided under the Families First Coronavirus Response Act.

- Beneficial Ownership Information Reporting Requirements (Financial Crimes Enforcement Network): FinCEN is promulgating proposed regulations to require certain entities to file reports with FinCEN that identify two categories of individuals: The beneficial owners of the entity; and individuals who have filed an application with specified governmental authorities to form the entity or register it to do business.

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS): CMS is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Additional Comment Period for Updated HRSA-Supported Women's Preventive Services Guidelines Statement on Breastfeeding Services and Supplies (HRSA): On August 20, 2021, HRSA published a notice soliciting public comments regarding proposed updated draft recommendations to the HRSA-Supported Women's Preventive Services Guidelines (Guidelines) in the areas of Well-Women Preventive Visits, Counseling for Sexually Transmitted Infections, and Breastfeeding Services and Supplies, which, when accepted by HRSA, are required to be covered without cost-sharing by certain health insurance issuers under the Public Health Service Act.

- Medicare and Medicaid Programs; Patient Protection and Affordable Care Act; Interoperability and Patient Access for Medicare Advantage Organizations and Medicaid Managed Care Plans, State Medicaid Agencies, CHIP Agencies and CHIP Managed Care Entities, Issuers of Qualified Health Plans on the Federally-Facilitated Exchanges, and Health Care Providers (CMS): This notification is to inform the public that CMS is exercising its discretion in how it enforces the payer-to-payer data exchange provisions.

- Agency Information Collection Activities; Request for Public Comment (Employee Benefits Security Administration): The Department of Labor (the Department), in accordance with the Paperwork Reduction Act, provides the general public and Federal agencies with an opportunity to comment on proposed and continuing collections of information.

- Advisory Committee on Immunization Practices (ACIP); Meeting (CMS) X2: In accordance with the Federal Advisory Committee Act, the Centers for Disease Control and Prevention (CDC) announces the following meeting of the Advisory Committee on Immunization Practices (ACIP).

- Submission for OMB Review; Comment Request (DoD): The DoD has submitted to OMB for clearance the following proposal for collection of information under the provisions of the Paperwork Reduction Act.

- Medicare Program; Hospital Inpatient Prospective Payment Systems for Acute Care Hospitals; Changes to Medicare Graduate Medical Education Payments for Teaching Hospitals; Changes to Organ Acquisition Payment Policies (CMS): These provisions implement policies based on legislative changes relative to Medicare graduate medical education (GME) for teaching hospitals provided by sections 126, 127, and 131 of the Consolidated Appropriations Act (CAA), 2021; and changes, clarifications, and codifications for Medicare organ acquisition payment policies relative to organ procurement organizations (OPOs), transplant hospitals, and donor community hospitals.

- 50th Anniversary of the National Cancer Act of 1971 (Executive Office of the President): A Proclamation–Half a century ago, on December 23, 1971, policymakers, researchers, cancer survivors, and advocates gathered at the White House for the signing of the bipartisan National Cancer Act—a landmark law that has helped transform cancer research and offered hope to millions in the years since.

- Federal Management Regulation (FMR); Persons Who Are Nursing in Public Buildings (GSA): GSA is issuing a bulletin for the FMR, titled ``Persons who are Nursing in Public Buildings.'' This bulletin supplements a previous bulletin on the subject, and clarifies space requirements and availability of lactation spaces in public buildings for both Federal employees and members of the public.

- Revision of Annual Information Return/Reports (EBSA): This document contains final revisions to the instructions for the Form 5500 Annual Return/Report of Employee Benefit Plan and Form 5500-SF Short Form Annual Return/Report of Small Employee Benefit Plan effective for plan years beginning on or after January 1, 2021.

ACA:

- Final 2021 numbers: This year’s Open Enrollment Period hit a historic high of more than 13.6 million people enrolled in health insurance coverage for a January 1, 2022 effective date through HealthCare.gov and State-based Exchanges (SBEs). The American Rescue Plan (ARP) has made coverage more affordable and accessible for people across the country: 92% of people in HealthCare.gov states who signed up for plans through December 15, 2021, will receive premium tax credits for 2022 coverage–more than 400,000 people will receive tax credits for 2022 coverage that would have been inaccessible to them prior to the ARP. More than 4.6 million Americans have newly gained health care coverage since the beginning of 2021. From the start of Open Enrollment through December 15, 2021, more than 9.7 million consumers enrolled in the 33 states using HealthCare.gov for 2022. This is over 900,000 more people than the previous all-time high of 8.8 million who signed up during the 2018 Open Enrollment Period with 39 states using HealthCare.gov. The 18 SBMs that use their own platforms reported to CMS that through December 11 (week six), almost 3.9 million consumers selected plans or were automatically re-enrolled in a plan for 2022 health coverage. This is up from last year when SBMs reported that 3.4 million consumers made a plan selection in the 15 State-based Marketplaces for 2021, through week six.

- Premiums: According to a Kaiser Family Foundation county-level analysis, average premiums for the Affordable Care Act Marketplace benchmark silver plan fell 3.1% across the country for 2022 (although the changes varied by location and type of plan). Because the American Rescue Plan Act temporarily increased and expanded subsidies for low- and middle-income individuals and families, tax credits will cover the full premium for the lowest-cost silver plan for a 40-year-old individual earning $20,000 (155% of the federal poverty level) in two-thirds of counties nationwide.

Medicare:

- Part B: In December, Chairman Ron Wyden (D-OR) of the Senate Finance Committee sent a letter to the Biden Administration asking for a reduction of the planned Medicare Part B premium increase. The increase is said to be contingency planning to cover the cost of Aduhelm, the FDA accelerated-approved Alzheimer’s drug. Chairman Wyden encouraged the Administration to stop the price increase by eliminating contingency planning for Aduhelm.

- PACE: According to AIS Health, the Medicare PACE program is making a comeback. Congressional lawmakers are considering additional funding for home and community-based services like this. Programs of All-Inclusive Care for the Elderly are designed to support elderly Americans who require a nursing home level of care by providing comprehensive medical care and social supports to help them remain at home, and it is believed that PACE competition is heating up as more venture capital firms look to invest in PACE organizations and as multiple states expand their programs. The PACE market has seen steady growth in recent years (currently serves about 51,000 participants in 30 states, up from 34,000 participants in 2015).

Around the Country:

Google in Healthcare: Google seems to have significant healthcare ambitions and is developing a new product to drive its broader healthcare strategy.

In an interview with AIS Health in October, Amy Waldron, Google Cloud’s global leader for health care and life sciences solutions, said Google is working on “data and analytics that are coming from cloud technology and from collaborations between payers and providers.” Can it revolutionize healthcare like it did online advertising?

Private Equity: Healthcare is an industry accustomed to spending growth and private equity is betting the economics of healthcare will continue to be favorable. With the administration's focus on Covid and the Build Back Better plan, private equity reform looks marginal for the time being. Therefore, we should expect more of the same healthcare investment themes in the private markets.

Those investments will include: telehealth (particularly, specialty platforms with a much more narrowed treatment focus), staffing, behavioral health, addiction treatment, and neuro-related rehabilitation services to name a few. PE is here to stay.

Opposition to the No Surprises Act: The American Medical Association (AMA) and the American Hospital Association (AHA), sued the Biden administration on Dec. 9, asking a federal court to block regulations officials developed to implement the No Surprises Act (NSA), parts of which go active on January 1. The suit alleges that federal officials stretched their legal authority beyond the legislation’s original intent. The AMA and AHA seek an emergency injunction blocking implementation of the October 7 interim final rule. A decision is expected early in the new year. Several regulators who met with the association at December’s NAIC meetings acknowledged that there are many question marks with regards to compliance. As a result, the consensus among them was that they had no intentions of enforcement actions while implementation is being figured out.

Drug Prices: The administration’s Build Back Better Act may not happen, but its proposed drug price controls will likely continue. There is still a lot of life around negotiating prices for high-cost drugs in Medicare and price controls for most drugs that would limit price increases to the annual inflation rate.

Committee Updates

Committee Updates: Most were done asynchronously via email with the NAIC and holiday activities this month. The association was able to leverage much of its committee efforts at the NAIC where it was able to advance many of the initiatives with state regulators. Along with state regulator meetings to discuss association interests, there were some key NAIC meetings of interest. A summary of these is as follows:

- Health Innovations (B) Working Group: The meeting commenced with a briefing from Dr. John Lumpkin of BCBSNC who discussed equity in health care. As such they are working on the NC Healthcare Index which is designed to drive improvement and looks at all aspects of where people “touch” the healthcare system. The group also discussed Alternative Payments Models which is any payment system other than fee for service. The working group is particularly interested in value-based payments.

- Improper Marketing of Health Insurance (D) Working Group: Martin Swanson from Nebraska conducted the meeting. He said the working group had two charges: 1) coordinate this area with federal and state regulators, and 2) review current models and guidelines with regards to marketing. The meeting had three presenters. The first was Katie Keith who advises non-profit consumer advocacy groups and cited many examples of abuses that hurt consumers. She suggested that the NAIC should do three things: 1) level the playing field with consumer protection, 2) hold insurers responsible for actions of downstream actors, 3) conduct surveys of enrollees to assess their satisfaction. The second presentation was the Alliance of HCSM with Randy Pate and Nancy Atkins. Nancy made the points that HCSMs are ACA-defined organizations and that each has religious faith at its core. Randy discussed how HCSMs work and provided a constitutional basis for them. Martin Swanson asked a question about how many issues overall do HCSMs get. He also asked about how to pass issues on to HCSMs. Another question was how can the alliance do more to get more HCSMs into the alliance. Matthew J. Smith of CAIF urged the DOIs to add “what to do if you have issues with HCSMs” on the websites to better protect consumers from fraud. The last presenter was AHIP that read a statement about the need for agents to do training. AHIP urges actions that don’t inhibit legitimate agent activities.

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email a.melgar@aaab.net.