Letter from the President

The first quarter of 2022 is already behind us, as we enter into Spring. We are pleased to welcome our newest AAAB members and invite you all to get more involved through different committees that may be of interest to you.

The first quarter of 2022 is already behind us, as we enter into Spring. We are pleased to welcome our newest AAAB members and invite you all to get more involved through different committees that may be of interest to you.

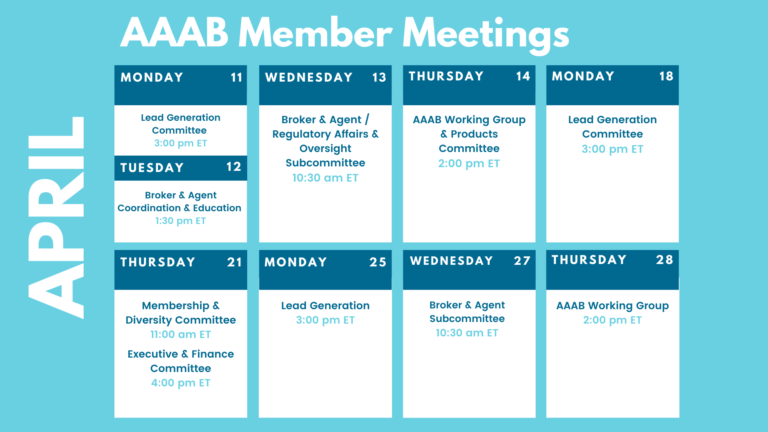

In this issue of AAAB Insights, check out the most recent regulatory updates out of Washington D.C. and across the country in Regulatory Updates and information from our most recent member committee meetings in Committee Updates. All of the April meetings are listed in the Members' Spot. If you would like to join a committee, please reach out and we can help you get involved.

For any questions or feedback regarding AAAB, please feel free to contact our leadership board via email at gfeng@aaab.net.

Brandon Wood

AAAB President

Regulatory Updates

From DC:

ACA:

- Small Group Stability: About half of small business employees worked for a company that offered health insurance from 2013 to 2020, and the small-group market has remained relatively stable since the implementation of the Affordable Care Act, according to a recent Urban Institute study.

- Enhanced Subsidies Create Inflation: The conservative Galen Institute’s recent report stated that the ACA failed to usher in an improved individual market for health insurance. In fact, despite $50 billion a year in subsidies for exchange plans, the number of Americans with private coverage is unchanged. Government spending on exchange subsidies largely crowded out private spending on health insurance.

Medicare:

- Medicare Advantage Concentration: According to AIS Health, about two-thirds of all new enrollees selected a plan from the market leaders UHC, Humana, and Aetna. However, many regional insurers performed well driven mostly by service area expansions, provider agreements, and enhanced benefits. In the west, SCAN Health Plan for instance expanded its footprint into Arizona and Nevada while adding a Part B premium “give-back” benefit to some plans. In the east, Highmark Health expanded into Delaware after signing agreements with ChristianaCare and Bayhealth.

- Medicare Advantage Enrollment Tops 28 Million: According to CMS the total MA population rose to 28.6 million medical lives at the end of February 2022. That represents an 8.5% year-over-year increase. On the state level, a few states like Delaware and Vermont saw MA growth of more than 20% as those states have historically had low penetration rates.

- Low AEP Switching. Medicare beneficiaries have more plan choices than ever before to include an array of supplemental benefits and increased PPO options, but even then plan switching has stalled according to a study from Deft Research. Medicare Advantage plans need to consider whether low switching is due to members feeling satisfied with their current coverage or overwhelmed with the sheer amount of information being presented to them. Switching is slightly down this year In its 2022 Medicare Shopping and Switching Study, Deft observed an overall switching rate of 11% during the most recent AEP. That’s compared with 12% seen in 2021 and 23% in 2015.

Federal Regulations: In the month of April, there were 14 new Federal register entries in the Healthcare Reform section. Those entries break down as follows:

- National Colorectal Cancer Awareness Month (Executive Office of the President): March 2022 is declared National Colorectal Cancer Awareness Month

- Agency Information Collection Activities: Submission for OMB Review; Comment Request (CMS) X 5: CMS is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Agency Information Collection Activities; Submission for OMB Review; Comment Request; Patient Protection and Affordable Care Act Patient Protection Notice (Labor Department): The Department of Labor is submitting this Employee Benefits Security Administration-sponsored information collection request to the Office of Management and Budget for review and approval in accordance with the Paperwork Reduction Act of 1995.

- Medicaid Program; Final FY 2018, Final FY 2019, Preliminary FY 2020, and Preliminary FY 2021 Disproportionate Share Hospital Allotments, and Final FY 2018, Final FY 2019, Preliminary FY 2020, and Preliminary FY 2021 Institutions for Mental Diseases Disproportionate Share Hospital Limits (CMS): This notice announces the final Federal share disproportionate share hospital allotments for Federal fiscal year (FY) 2018 and FY 2019, and the preliminary Federal share disproportionate share allotments for FY 2020 and FY 2021.

- Agency Information Collection Activities; Request for Public Comment (Employee Benefits Security Administration): The Department of Labor, in accordance with the Paperwork Reduction Act, provides the general public and Federal agencies with an opportunity to comment on proposed and continuing collections of information.

- Annual Civil Monetary Penalties Inflation Adjustment (HHS): The Department of Health and Human Services is updating its regulations to reflect required annual inflation-related increases to the civil monetary penalty amounts in its regulations, under the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015.

- Agency Information Collection Activities; Submission to the Office of Management and Budget (OMB) for Review and Approval; Comment Request; American Community Survey 2022 Content Test (Census Bureau): The Department of Commerce will submit the following information collection request to the Office of Management and Budget for review and clearance in accordance with the Paperwork Reduction Act of 1995.

- Announcement of the Advisory Panel on Outreach and Education (CMS): This notice announces the next meeting of the APOE in accordance with the Federal Advisory Committee Act.

- Agency Information Collection Activities: Proposed Collection; Comment Request (CMS): The Centers for Medicare & Medicaid Services (CMS) is announcing an opportunity for the public to comment on CMS' intention to collect information from the public.

- Agency Information Collection Activities; Submission for OMB Review; Comment Request; Affordable Care Act Internal Claims and Appeals and External Review Procedures for ERISA Plans (Labor Department): The Department of Labor (DOL) is submitting this Employee Benefits Security Administration (EBSA)-sponsored information collection request (ICR) to the Office of Management and Budget (OMB) for review and approval in accordance with the Paperwork Reduction Act of 1995 (PRA).

Around the Country:

- FTC Stalled on PBM Probe: The Federal Trade Commission (FTC) won’t investigate PBMs’ business practices, despite considering a probe at a February 17th meeting. The FTC’s four commissioners deadlocked 2-2 on a party line vote to authorize an investigation. The two Democratic commissioners voted in favor of an investigation while the two Republicans voted against it.

- UHC Merger Blocked: UnitedHealth will fight DOJ move to block Change Healthcare deal. The DOJ on Feb. 24 sued to block UnitedHealth Group’s proposed $13 billion acquisition of Change Healthcare, arguing that the deal would negatively impact competition not only in commercial health insurance markets but also the market for technology that allows insurers to process claims and reduce health care costs.

- Indictments: A federal grand jury in East St. Louis returned an indictment charging a former owner and two top executives of a south Florida telemarketing business known as Simple Health with federal fraud offenses. Former owner Steven Dorfman, 37, of Fort Lauderdale, FL, former Chief Compliance Officer, Candida L. Girouard, 45, of Valrico, FL, and former Vice President of Sales John A. Sand, 47, of Fort Lauderdale, FL, were all charged with one count of conspiracy to commit mail and wire fraud, four counts of mail fraud, and eight counts of wire fraud.Simple Health, also known as Health Benefits One, sold health insurance policies over the phone. The vast majority of the policies sold by Simple Health were limited indemnity plans but they were being positioned as ACA-compliant health plans.

- Drug Approval: The FDA on March 4 approved Bristol Myers Squibb’s Opdivo for the treatment of resectable non-small cell lung cancer (NSCLC) before surgery in the neoadjuvant setting in conjunction with platinum-doublet chemotherapy. The lightning-fast approval came within days of the agency’s priority review acceptance. As a systemic therapy for NSCLC, Opdivo holds covered or better status for 67% of all insured lives under the pharmacy benefit. 88% of all insured lives have covered or better access to Opdivo under the medical benefit.

- Pharma Lobbying: According to the Keckley Report, the US pharmaceutical industry which generates $363 billion in annual revenue has spent $5,066,805,717 on its lobbying activities between 1998 and 2021. That is more than any other industry and 56% more than the American health insurers that are the number two largest spender on lobbyists. Rounding out the healthcare industry, that is 145% more than hospitals and nursing homes and 191% more than health professionals spending on lobbying. In 2021, the pharmaceutical industry spent $353,940,506 on lobbying activities for 546 companies employing 1,746 lobbyists (58% of who previously worked for the government).

- Startup Insurers’ Red Ink: Start-up/publicly traded health insurance companies had $2.5 Billion in losses in 2021. As has been the case in previous quarters, all four of the newly public health insurance startups — Oscar Health, Inc., Bright Health Group, Inc., Clover Health Investments Corp. and Alignment Healthcare, Inc. — reported losses for the final three months of 2021.

- Proposed Budget: What’s also notable about the proposed federal budget is the importance of healthcare in it. Federal funding for Medicare and Medicaid are forecast to grow faster than overall federal receipts where outlays increase from 20.2% in 2022 to 29.2% in 2031 per OMB’s forecast.

- New Name: Anthem, Inc. said recently that it will rename itself “Elevance” in a bid to be seen as a diversified enterprise, known as much for its technology and business services branches as its traditional health insurance business. Sounds a lot like what Optum does as the largest health insurance firms have all diversified their businesses, causing an encroachment of tech and investment firms in the health care sector.

Committee Updates

Committee Updates:

- Broker Committee: The committee’s main effort continues to be around the Compliance Toolbox. A draft matrix to help guide members on compliance has been completed and should be finalized in the next month.

- Independent Agent Subcommittee: The subcommittee has been working on the specific system requirements for the various levels of membership: industry, associate, and individual.

- Membership/Diversity/Product Committee: The committee is pursuing about a dozen various prospects and asks everyone in the AAAB community to provide any and all referrals.

- Product Committee: The Executive Committee authorized the consolidation of this committee under Membership/Diversity.

- Regulatory Affairs Committee: This committee has been rolled under the bi-weekly call where a briefing on current regulatory affairs occurs.

Members' Spot

Upcoming Member Opportunities

Get involved! If you aren't currently serving on a committee, but would like to, please email gfeng@aaab.net.